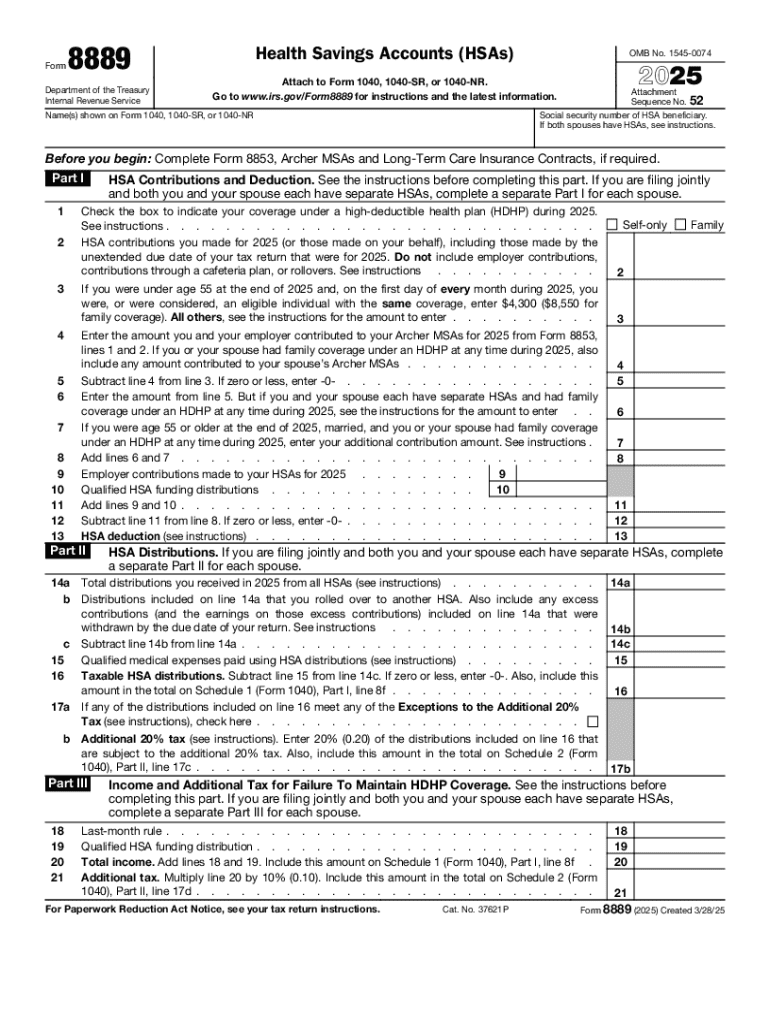

IRS 8889 2025-2026 free printable template

Instructions and Help about IRS 8889

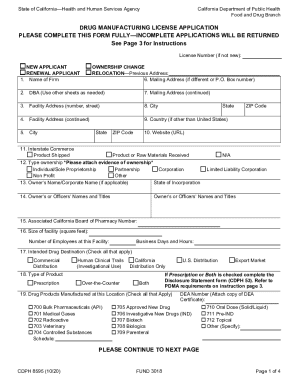

How to edit IRS 8889

How to fill out IRS 8889

Latest updates to IRS 8889

All You Need to Know About IRS 8889

What is IRS 8889?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8889

What should I do if I need to correct an error on my IRS 8889?

If you discover an error after filing your IRS 8889, you should submit an amended return using Form 1040-X to correct any mistakes. Ensure you provide accurate information and clearly indicate which entries are being corrected. Remember to include a copy of the original IRS 8889 to avoid confusion.

How can I check the status of my filed IRS 8889?

To verify the status of your filed IRS 8889, you can use the IRS 'Where's My Refund?' tool if expecting a refund, or check the online account system provided by the IRS. Be aware that processing times can vary, especially during peak filing seasons.

What are some common errors to avoid when filing the IRS 8889?

Common errors when filing the IRS 8889 include failing to report all contributions or distributions, incorrect formatting of dates, and not signing the form. It's important to review all entries thoroughly and utilize reliable tax software to minimize the risk of these mistakes.

What should I do if my e-filed IRS 8889 is rejected?

If your IRS 8889 is rejected when e-filing, the IRS will provide a rejection code explaining the issue. Carefully address the error indicated and re-submit the form through your e-filing software. Most providers will guide you through the correction process after a rejection.

Are there any specific privacy concerns when filing IRS 8889 electronically?

When electronically filing your IRS 8889, ensure that you are using secure software that complies with IRS standards for data protection. Keep your personal information confidential and monitor your IRS account for any suspicious activities post-filing.

See what our users say